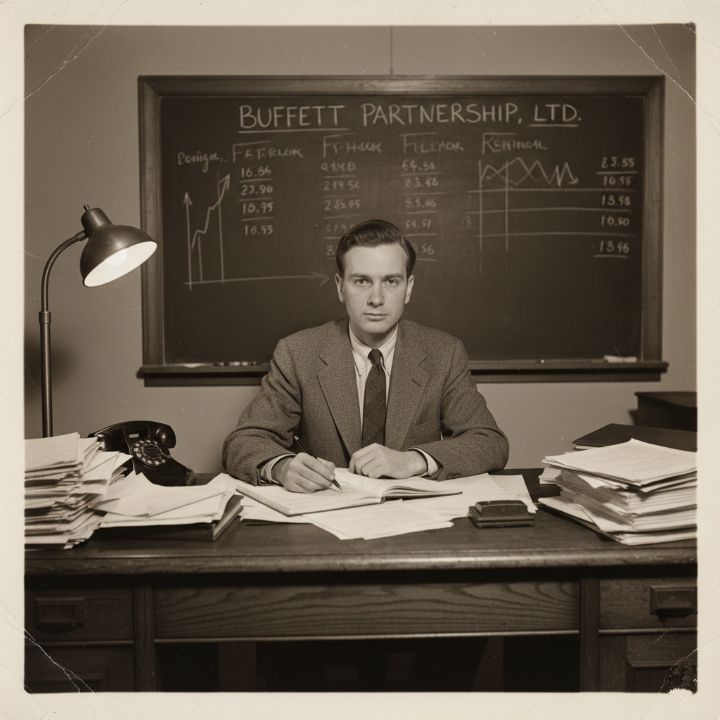

The quiet secret behind lasting financial and personal success.

Story: (Why?)

Warren Buffett didn’t become a billionaire overnight. In fact, he earned nearly 80% of his wealth after turning 60. The secret? Time, patience, and the power of compounding. Compounding isn’t just about money — it’s about habits, skills, and knowledge growing exponentially over time.

Insight:

Many people chase quick wins — a high-return stock, a viral product, or a fast business hack. But real wealth, both financial and personal, comes from consistent, small actions stacked over years. One smart investment, one skill practiced daily, or one habit repeated every day can multiply into massive results if given time.

Takeaway:

- Start early: Even small investments or habits matter.

- Be consistent: Daily incremental progress beats random big wins.

- Patience > Hustle: Waiting for compounding to work is not passive — it’s strategic.

Action:

Pick one “compounding habit” today — it could be:

- Saving/investing ₹500 per day or week.

- Reading 15 pages of a business/finance book daily.

- Writing reflections on your progress every night.